how to pay indiana state taxes quarterly

Connect With An Expert For Unlimited Advice. Learn about state requirements for estimated quarterly tax payments.

Account Id And Letter Id Locations Washington Department Of Revenue

Thats why we recommend using tax software see below.

. Will not have Indiana tax withheld or If you think the. If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. 0101 Step 2 Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources.

Know when I will receive my tax refund. If the due date falls on a national or state holiday Saturday or Sunday payment postmarked by the day following that holiday or Sunday is considered on time. Any employees will also need to pay state income tax.

Write your Social Security number on the. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one. How to pay quarterly taxes Once youve calculated your quarterly payments You can submit them online through the Electronic Federal Tax Payment System.

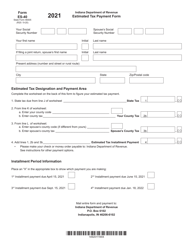

Indiana dept of workforce development po. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. Paying the IRS Federal The easiest way to make a federal quarterly tax payment is to use IRS Direct Pay.

The final quarterly payment is due on January 15 of the following year and covers taxes on income from September 1 through December 31. The Indiana income tax rate is set to 323 percent. However as of 2013 all Indiana.

As you can see through the IRS form figuring out your own quarterly payments is incredibly difficult. Pay the amount due on or before the installment due date. 2 Enroll in the Electronic Federal.

Find Indiana tax forms. Estimated payments can be. Dont Know How To Start Filing Your Taxes.

To make an estimated tax payment online log on to wwwingovdor4340htm. Formerly many Indiana withholding tax payers could pay on paper by sending in Form WH-1 Indiana Employers Withholding Tax Return with a check. If you expect to have income during the tax year that.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax. Enclose your check or money order made payable to the Indiana Department of Revenue. Your payment amount use our calculator On the first screen select Estimated.

Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. File Quarterly UI Tax Reports and Payments In Indiana UI tax reports also known as premium reports and payments are due on or before the last day of the month following the. However some counties within Indiana have an additional tax rate making the.

Box 7054 indianapolis in 46207-7054 amount due total gross wages paid this qtr see instructions line 2 minus line 3 line 4 x applied rate. You can also pay. Find Indiana tax forms.

Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Estimated payments may also be made online through Indianas INTIME website.

Visit IRSgovpayments to view all the. Know when I will receive my tax refund. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app.

Connect With An Expert For Unlimited Advice. Dont Know How To Start Filing Your Taxes. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

We last updated the Estimated.

Taxation Of Social Security Benefits Mn House Research

Dor Make Estimated Tax Payments Electronically

Taxation Of Social Security Benefits Mn House Research

Indiana Sales Tax Small Business Guide Truic

Economic Nexus Laws By State Taxconnex

Indiana State Tax Information Support

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Indiana Ifta Fuel Tax Requirements

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Helpful Sales Tax Steps For Amazon Fba Sellers Sales Tax Amazon Fba Business Tax Return

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

Cell Phone Taxes And Fees 2021 Tax Foundation

Indiana Estimated Tax Payments 2021 Fill Online Printable Fillable Blank Pdffiller

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Dor Keep An Eye Out For Estimated Tax Payments

Solved How Do I Enter State Estimated Tax Credits To Turb

Dor Keep An Eye Out For Estimated Tax Payments

Bender S State Taxation Principles And Practice Lexisnexis Store

How Is Tax Liability Calculated Common Tax Questions Answered